Property Prices in Malta

These documents contain excerpts about property prices in Malta, mdina and valletta obtained from the Central Bank Annual Reports issued between 1998 and 2009. Excerpts taken from the Central Bank Annual Reports:

http://www.centralbankmalta.com/site/publications2.asp

To view a particular document click on one of the 'View Report' links below. You are also

able to download the respective documents by right-clicking on one of the 'Download Report' links and selecting 'Save Target As...'

View Report: [2009] [2008] [2007] [2006] [2005] [2004 - 2001] [2000 - 1998]

Download Report: [2009] [2008] [2007] [2006] [2005] [2004 - 2001] [2000 - 1998]

2009 Report

Construction

Reflecting a decline in investment in housing and commercial property, the construction sector registered a fall in production during 2009.

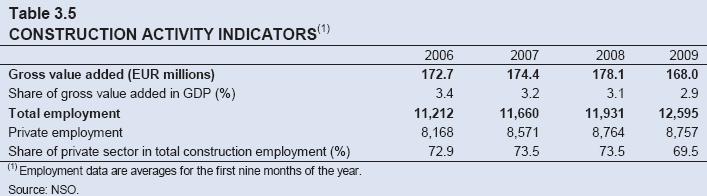

National income data show that, in nominal terms, its GVA declined by 5.7%, leading to a further reduction of the sector’s share in nominal GDP. In terms of the distribution of this GVA, employee

compensation dropped by 5.1%, following the 1.7% rise reported in the previous year. The profit element dropped by 9.7%, after having increased by 2.2% in 2008.

Data on GFCF from the expenditure side of GDP show an 18.5% drop in construction investment in 2009. The residential building component accounted for 92.2% of the decline, while the remainder

was attributable to other construction types, as both the Government and the private sector reduced their level of investment spending.

Average employment in the construction sector increased in the first nine months of the year compared to the corresponding period of 2008. However, this was almost entirely due to a reclassification

involving the shift of a substantial number of public sector employees from the ‘agriculture, hunting & related services

activities’ category to the construction category following changes to ministerial portfolios. Meanwhile, employment in private sector construction was virtually unchanged from a year earlier (see Table 3.5).

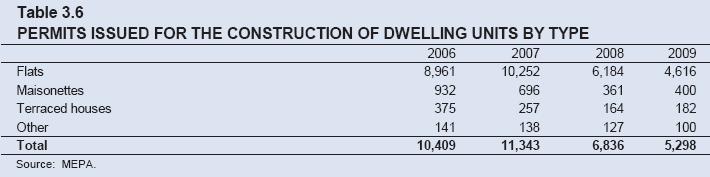

A key indicator of developments in the construction sector, the number of permits issued by MEPA, showed that for the second year running there was a significant reduction in the issue of such permits for dwellings.

Overall, the number of permits dropped by 22.5% to 5,298, in line with the drop in prices for residential property

experienced since 2008 (see Table 3.6). Permits for the largest category, apartments, fell by 25.4%. However, permits for the construction of maisonettes and terraced houses each increased by almost 11%, to 400 and 182, respectively.

Residential Property Prices

The Bank’s index of advertised residential

property prices registered a decline of 5.0% in 2009. While this contraction was more pronounced than the previous year’s decline of 2.7%, signs of a stabilisation in prices began to emerge towards the end of the year. Thus, after the index recorded a drop of 9.9% in the first quarter,

the decline in property prices became less pronounced as the year progressed (see Chart 3.7).

Disaggregated results show that the fall in asked prices was spread across six of the eight property categories

contained in the index. Prices for flats, both finished and in shell form, which together made up 57% of the sampled properties, were down by 5.3% and 10.2%, respectively. Those for finished maisonettes and maisonettes in shell form, which accounted for 18% of the sample,

dropped by 4.5% and 4.9%, respectively. Meanwhile, asked prices for houses of character and townhouses fell by 7.5% and 2.6%, respectively.

On the other hand, higher prices were being asked for the two remaining categories: terraced houses, whose prices rose by 3.2%, and villas, where the increase was only marginal. These two categories together

represented 11% of the sample.

A further indicator of sluggish conditions in the housing market was the number of advertised properties, which dropped by 20.6% compared with 12.6% in 2008. This notwithstanding, data for the last two

quarters of 2009 showed a moderation in the rate of decline of this indicator.

|