Property Prices in Malta

These documents contain excerpts about property prices in Malta, mdina and valletta obtained from the Central Bank Annual Reports issued between 1998 and 2009. Excerpts taken from the Central Bank Annual Reports:

http://www.centralbankmalta.com/site/publications2.asp

To view a particular document click on one of the 'View Report' links below. You are also

able to download the respective documents by right-clicking on one of the 'Download Report' links and selecting 'Save Target As...'

View Report: [2009] [2008] [2007] [2006] [2005] [2004 - 2001] [2000 - 1998]

Download Report: [2009] [2008] [2007] [2006] [2005] [2004 - 2001] [2000 - 1998]

2004 Report

Developments in the property

market exert an impact on household wealth and

thus may influence aggregate demand, output and

inflation. Given the importance of price indices

related to this sector, the Central Bank of

Malta upgraded the index it uses to measure

price changes in residential property. The new

index, which goes back to 1980, captures all

advertised properties in Malta and Gozo except

those for commercial purposes.

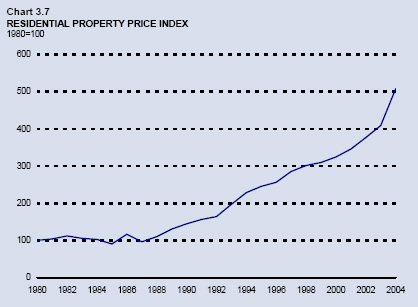

According to the new index,

advertised property prices continued to

accelerate in 2004, rising by an estimated 24.2%

on average. Thus, the general upward trend in

residential property prices, in evidence since

1989, persisted (see Chart 3.7). The increase in

average prices was, to an extent, inflated by

developments in u p-market units, as growth

based on median prices was somewhat slower.9

Prices of all property types rose during 2004,

with the sharpest growth registered in the

asking prices of town houses and finished flats.

These increases took place against a background

of low interest rates and may have reflected a

shift in preferences for investment in real

estate as opposed to financial assets, on

account of attractive mortgage financing

opportunities.

2003 Report

Real estate prices, together

with the prices of other assets held by

households, affect private consumption through

the wealth effect and may be indicators of

future developments in output and demand.

Furthermore, higher house prices often

contribute to rapid growth in household debt,

with implications for the stability of the

financial sector. For these reasons, and also

because developments in real estate prices are

of interest per se, the Bank monitors house

price movements on a quarterly basis through an

index of asking prices, stratified by type and

locality.

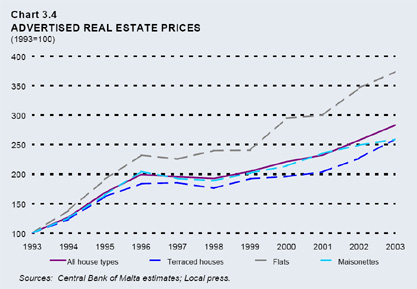

Chart 3.4 illustrates trends

in the average asking price of dwellings

(including finished terrace houses and flats and

maisonettes in shell form) over the eleven years

to 2003. This measure suggests that house prices

doubled between 1993 and 1996, after which a

short period of relative stability ensued. The

upward trend resumed in 1999 although at a more

moderate pace than in the early nineties. The

rise in house prices in 2003 is estimated at

around 10%, roughly the same as that recorded in

2002. Prices of all property types rose during

the year under review, with flats and terraced

houses showing the sharpest increases.

House price inflation in

2003, which was more rapid than consumer price

inflation, may have been fuelled by the relative

unattractiveness of financial assets,as interest

rates continued to fall and the capital market

remained weak. This, combined with the inflow of

funds from abroad under the Investment

Registration Scheme, may have induced investors

to purchase real estate for investment purposes

instead.

2002 Report

Real estate prices, as well

as the prices of other assets held by

households, affect private consumption through

the wealth effect. They are also of interest per

se, because they refer to a large and important

market. The Central Bank monitors house price

movements through an index of asking prices,

stratified by type and locality. Chart 2.6

illustrates trends in the average asking price

of dwellings (including finished terraced houses

and flats and maisonettes in shell form) over

the ten years to 2002.

As can be seen in the Chart,

this measure indicates an acceleration of

property price inflation in 2002, although this

was not as pronounced as the one observed in the

mid-nineties. There is some evidence to suggest

that this development may have been due to the

inflow of funds from abroad in connection with

the Investment Registration Scheme5 combined

with the weak performance of the capital market.

In this case, property price inflation can be

expected to moderate in the future.

2001 Report

Since movements in property

prices may lead to an increase in underlying

inflationary pressures, the Central Bank

monitors trends through an index of asking

prices for property, stratified by type and

locality. This approach, however, has a number

of shortcomings. Asking prices are usually

higher than contracted prices, and properties

placed on the market at different points in time

may not be strictly comparable.

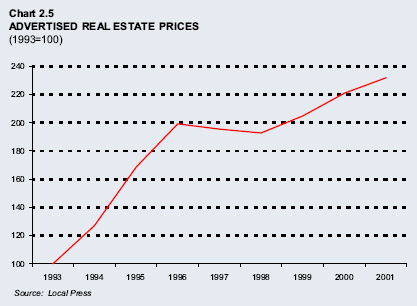

Chart 2.5 illustrates

movements in average asking prices of real

estate (including finished terraced houses and

flats, and maisonettes in shell-form) as

advertised in the local press over the last nine

years. The Chart suggests that house prices

doubled between 1993 and 1996. This was followed

by a short period of relative stability, as the

property boom came to an end. But the upward

trend resumed in 1999, though the rise of these

last years was more moderate than the

double-digit growth of the early nineties. In

fact, the rise in real estate prices during

2001, estimated at under 5%, was only slightly

more rapid than that in the RPI. The increase

was also slower than that recorded in 1999 and

2000, and was mainly concentrated in the central

region.

In recent years the demand

for residential property has shifted away from

terraced houses towards flats and maisonettes.

This probably reflects demographic and social

trends which are giving rise to smaller family

units. Since the supply of flats and maisonettes

is much larger than that of terraced houses,

this shift in preferences may be one of the

factors behind the recent slowdown in property

price inflation.

|