|

Malta Citizenship

Malta Citizenship

In September 2013, Malta's Government announced the launch of the Malta Individual Investor Programme or MIIP.

Under this first Malta Citizenship by Investment Programme upstanding members of the global society having sufficient

evidence of clean source of wealth, would be eligible for Malta Citizenship on making contributions to and investments

in Malta's economy.

The announcement attracted mixed reactions from the Maltese people that had only a few months earlier voted in a new

government. An open even if at times vociferous debate ensued both in our Parliament as well as at the European

Parliament. For four months, the proposed Malta Citizenship by Investment rules were scrutinised from constitutional,

international law as well as public sentiment perspectives.

The two sides of Malta's bicameral parliamentary system left and returned to the negotiating table a good number of

times before compromise was reached in early 2014 on the addition of the approved investment as well as a property

requirement. The last remaining political hurdle to be overcome was the dissent expressed by the European

Parliament weeks earlier. Not enjoying any jurisdiction on matters of nationailty and citizenship and keen

to put this matter behind it, the European Commission met with a Maltese delegation and, within the day,

agreed out the terms of Europe's first, EU-approved Malta Citizenship by Investment Programme.

Malta Citizenship Criteria

- A non-refundable Contribution of €650K to the Malta Social & Development Fund, with additional lower

contributions for dependent family members

- An Investment in Approved Bonds or Securities amounting to €150K for a minimum of 5 years;

- The Purchase of Residential Property in Malta (min. value of €350K) or the Rental

(min. €16K per year for a min. of 5 years)

- Evidence of a Genuine Link with Malta including Malta Resident status for a minimum of one year

Malta Citizenship Applications so far

Malta Citizenship Applications so far

Since the European Commission's approval last February, various firms has handled applications for

Citizenship. Identity Malta have been very supportive in our applications and have

demonstrated the seriousness and professionalism that was promised by our Government in their dealings

as Accredited Persons as well as esteemed clients who ventured to be the first candidates

for Malta's Individual Investor Programme.

Long-standing clients who have enjoyed Maltese residence status for a number

of years will be proud citizens of Malta within 6 months of their application, given that they have

fully satisfied all the onerous requirements of the MIIP including residence. For those who have invested

significantly in Malta over the years, moving their centre of life to Malta, family and all, and who have

created jobs and contributed to a better Malta, the Maltese passport is an important recognition of their

true love of Malta.

Alongside the Malta Global Residence Programme, the Malta Citizenship Programme promises to be another

success, joining the portfolio of successes that Malta has under its belt in building what is a vibrant,

sound and agile financial services centre, that is disproportionate to Malta's small size.

Immigration Law & Relocation

Immigration Law & Relocation

An enviable climate, a notable and chequered history and a rich culture contribute to Malta's attraction as

an ideal immigration location. Malta's remittance based tax system and special tax status for qualifying

expatriates offers unrivalled quality living and tax optimisation opportunities. Malta's residence and

citizenship programmes attracts EU and non-EU nationals who are highly qualified persons, High Net Worth

Individuals, entrepreneurs and retirees looking for an alternative residence for private, business or

financial purposes.

With Malta's growing reputation as a high quality living destination and a tax-efficient residence solution

in the European Union, Malta immigration lawyers increasingly advised on tax optimisation

opportunities of moving to Malta under the appropriate residence scheme or residence program.

Malta’s lure as a popular immigration location can be found in various factors, including

- security and a high standard of living

- hospitable multilingual people

- visa-free travel to over 50 countries, including Schengen member states

- straightforward monetary repatriation through an excellent banking infrastructure

- beneficial tax schemes and an extensive network of double taxation agreements

- no minimum stay requirement

- remittance basis of taxation for resident non-domiciled persons.

- Immigration Law in Malta

The inward movement of foreigners into the Maltase Islands is regulated by the Chapter 217 of the Laws of

Malta: the Immigration Act.

The Immigration Act regulates:

The Immigration Act regulates:

- the exemption of foreign spouses of citizens of Malta and their dependents under 21 from the

requirement of periodical permission from the Immigration Authorities

- the granting of temporary residence permits

- the granting of permanent resident permits

- the granting of permission for foreigners to work in Malta.

The different types of residence listed above can be bundled into the following specific

schemes or types of residence:

- Malta Ordinary Residence Scheme

- Malta Global Residence Programme

- Malta High Net Worth Residence Scheme - European Nationals (Now The Residence Programme Rules)

- Malta High Net Worth Residence Scheme - Non-European Nationals (now the Malta Global Residence Programme)

- Highly Qualified Persons Rules: Aviation Executives , Gaming Executives , Financial Services Executives

Immigration Practice

Be it for employment or business purposes, for financial reasons or simply to enjoy living in a welcoming

jurisdiction, Malta offers a residence status that best suits each person’s circumstances. Furthermore,

in order to provide a holistic service, co-operation exists with a number of overseas law firms, immigration

professionals, real estate specialists and foreign tax practitioners in order to provide professional

assistance and advice on relocation and tax residence which goes beyond basic legal requirements.

Immigration Lawyers

In providing Malta relocation advice, immigration Lawyers focuses on the particular needs of the individual or family

and matches up the client’s requirements with the criteria of the several Malta tax schemes available.

Advise is given on the legal and tax rules and implications of taking up ordinary residence in Malta for

European Union nationals and handle the applications process. As registered mandatories, Lawyers take

care of residence applications for EU and non-EU individuals that decide to take up residence

under the special tax scheme available. Malta citizenship applications handling is also a service

that the immigration team offers.

In providing Malta relocation advice, immigration Lawyers focuses on the particular needs of the individual or family

and matches up the client’s requirements with the criteria of the several Malta tax schemes available.

Advise is given on the legal and tax rules and implications of taking up ordinary residence in Malta for

European Union nationals and handle the applications process. As registered mandatories, Lawyers take

care of residence applications for EU and non-EU individuals that decide to take up residence

under the special tax scheme available. Malta citizenship applications handling is also a service

that the immigration team offers.

Immigration lawyers seek to project manage the relocation process for our clients. They do not merely

tackle the legal aspects involved in changing residence such as permits, applications and real estate

contracts. They go beyond traditional legal requirements and also seek to ease the obligations and

responsibilities associated with this area. This is done through collaboration with external

collaborators, suppliers, contracts and other involved parties – with the intention of making such

an important, personal, life-changing process – easier and more manageable.

The Malta Ordinary Residence status is an attractive residence status currently available to

EU & EEA nationals and nationals of Switzerland, Liechtenstein, Norway and Iceland seeking to

transfer their tax residence to a safe, high quality and tax-efficient jurisdiction such

as Malta.

Eligibility for Malta Ordinary Residence

- Nationalities eligible to ordinary residence in Malta include all EU and EEA

nationals as well as nationals of Switzerland, Liechtenstein, Norway and Iceland.

- Applications are approved for non-EU nationals at the discretion of the authorities.

- Applicants for ordinary residence status need to demonstrate financial independence

without being subjected to complex means eligibility testing.

- Ordinary residents need to evidence their local residential address by purchasing

or renting a house or apartment in Malta. This needs to be available at the time of

filing of the application.

- Ordinary residents may live and enter into any business or employment in Malta.

- Holders of ordinary residence permits are allowed to convert to other

available residence schemes.

Remittance Based Tax System for Malta Ordinary Residence

Residents of Malta under the ordinary residency scheme and who are not domiciled in Malta are taxable

on a remittance basis. Accordingly, ordinary residents are not taxable on foreign source income not

received in Malta and also not taxable on any capital gains arising outside Malta, whether remitted

to Malta or otherwise.

Residents of Malta under the ordinary residency scheme and who are not domiciled in Malta are taxable

on a remittance basis. Accordingly, ordinary residents are not taxable on foreign source income not

received in Malta and also not taxable on any capital gains arising outside Malta, whether remitted

to Malta or otherwise.

Conditions of ordinary residence permits allow resident permit holders to take up residence in Malta

and physically live in Malta with the possibility of taking up employment and doing business in

Malta.

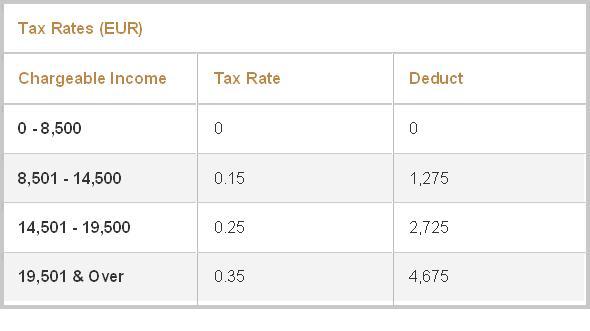

Tax Rates for Single Taxpayers

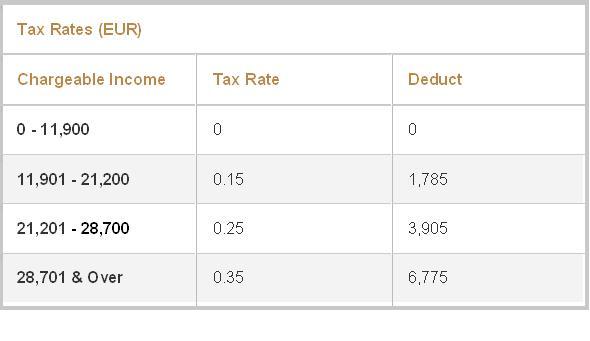

Tax Rates for Married Taxpayers

Tax Rates for Married Taxpayers

Ordinary Residence Permit Application Process

Ordinary Residence Permit Application Process

Applications for Ordinary Residence permits are generally processed within a shorter time compared

with other residence permit applications.

Ordinary Residence Services

Advocates are registered authorised mandataries according to law and are authorised

by the Maltese immigration and tax authorities. Advocates are able to advise you on the tax and legal

implications and requirements of the residence application process and indicate expected time

frames based on the specific circumstances and nature of your application. Their advice covers

the rules applicable to immigrating to Malta under a number of available residence schemes as

well as practical relocation assistance ranging from transportation and insurance to schooling

and health insurance coverage.

|